Appleton Common Council District 6 Update for November 13, 2022

Good afternoon District 6 neighbors,

I will be honest; the Packers have not been “must see TV” for me this season. However, since today’s foe is my least favorite NFL team, I plan on tuning in. Therefore, I want to share some thoughts on the special session of the Common Council last Wednesday where we adopted the 2023 Executive Budget before the game starts.

The council adopted the budget 12-2. This was the culmination of months of work for city staff and several weeks of work for council members as we review each department’s proposed budget and submit questions to department heads to be answered before “Budget Saturday”, where each department presents their budget and takes additional questions from council members. A shout out to former Council President Kyle Lobner for starting the policy of submitting questions in advance so that we can read everyone’s questions and answers. Thanks also to Finance Committee Chair Brad Firkus and city staff for compiling and distributing all the questions to all alders. This has saved hours of time on Budget Saturday, where the Finance Committee voted to recommend the proposed budget for approval. There was a budget listening session in October where citizens could ask questions and give their input on the budget, and a public hearing on November 2 where, once again, citizens were invited to give their input about the budget.

There were four amendments submitted to the budget, all of which were defeated. Two of the amendments proposed to take funds from the Common Council budget – for training ($1400) and parking passes for council members ($6480) to put into the Public Works Department concrete reconstruction budget. I couldn’t figure out why it wasn’t the full amount budgeted for parking passes, but then Alder Doran shared his proposal – that alders pay for parking each time they come to City Hall for a meeting and then submit a request for reimbursement. The amount left would allow $4.00 per month per alder to be reimbursed for parking. This would, of course, take time for us and for the city staff who would need to process these small reimbursements. It would also take more time for alders who may be rushing from their jobs to make a committee meeting. The parking pass funds are basically just a transfer to the Parking Utility. The training budget ($93.33 per alder) allows for newly elected alders to take the League of Wisconsin Municipalities Local Government 101 class, which I found invaluable when I first took office. We will be addressing an amendment for 2024 in a special session of the Human Resources and Information Technology committee on Wednesday evening at 6:15 which proposes eliminating the parking passes and rolling the price of a parking pass ($480 for 2023) into the alder salary.

Alder Doran’s other amendment, which was shared with us at 11:00 on Monday night before the budget adoption meeting on Wednesday, proposed to add $433,512 to the concrete reconstruction budget by cutting 10 to 32% of part-time wages in several departments and by cutting security at the library, a proposed deputy director position in Information Technology (to be funded by transferring another open position) and $22,500 in Network Security and Software Support in the Information Technology Department. At the budget adoption hearing, each department head explained the reduction in services that these cuts would require – most of the Parks and Recreation Department’s recreation and grounds maintenance staff in the summer is part-time, for example. The recreation and exercise programs through the Parks and Recreation Department and the children’s programs at the library are wonderful low-cost resources for our community and the loss of those at a time of increasing prices would be devastating for many families in my opinion. The amendment failed, with only two voting in favor.

I agree that we need to address our infrastructure needs, but taking money away from park maintenance and recreation programs or from critical information technology security needs (local governments around the country have been victims of ransomware) seems very short-sighted. Appleton recently began a study of a transportation utility that would treat roads like the water, wastewater and stormwater utilities, where the cost burden is based on usage. Under the first models we saw, the average homeowner would end up paying less than they currently pay with the wheel tax, which does not cover the full cost of street construction, but only replaces special assessments, because businesses and entities that don’t currently pay property taxes or the wheel tax would pay their fair share. However, the study was put on hold pending a lawsuit by a business group over a similar plan instituted in Peewaukee.

The last amendment was submitted by Alder Hartzheim. She proposed reducing the 5% merit raise budget for city employees to 4%, with the tax levy being reduced by $193,726. This would amount to from $3.26 to $3.36 per $100,000 in assessed home value, depending on the county. So, for District 6 residents with a home assessed at $200,000, the proposed tax increase would fall by $6.72. When departmental budgets were being prepared, each department was tasked with reducing their budget by 4% in order to allow for the employee raises. As I have noted, we are lucky to have not seen the turnover that other governments have seen – at one point, Outagamie County was losing an employee every day. The Outagamie County budget for next year continues incentive payments to keep employees from leaving. Our city employees are responsible for the high quality city services we enjoy, and most of them are taxpayers as well. Even the 5% raise does not keep up with the current rate of inflation, and analysis of Bureau of Labor Statistics data shows that city workers are paid less than employees in the private sector. I believe that supporting our employees and preventing loss of services and additional costs incurred from high turnover is worth more than this small reduction. That amendment also failed with only Alder Hartzheim in favor.

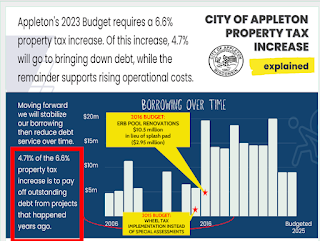

I am not happy that we are having to raise the property tax amount in this time of rising prices. When I made my plans to retire early (literally one month before COVID), the current economic environment was not part of my husband’s and my calculations. I have recently taken another part-time job to allow for some of the little extras that have become harder to afford. However, I voted for this budget because I believe that it does the best job of balancing the needs of the city with responsible stewardship of our tax dollars. The majority of the tax increase goes to pay down debt incurred in prior years, while the remainder supports operational costs.

(Graphics courtesy of the Mayor’s Office and Alder Van Zeeland)

The Capital Improvement Program, which pays for long-term projects like streets, sidewalks, buildings and parks has amounted to $273.7 million over the 10 years from 2013 through 2023. Of that amount, 4.61% is for the new library building. I believe that some news reports give the impression that the reason for the tax increase is the cost of the library.

Moving on to the Common Council meeting for Wednesday evening, I would expect only the alder salaries item to get separated for individual consideration. I write this not knowing how the recommendation will come out of the special committee meeting. The rest of the items seemed fairly straightforward at committee, although there was some objection to the street reconstruction plan for Linwood Avenue, particularly regarding the removal of some street parking.

As always, you can view meeting agendas, minutes and video here:

Comments

Post a Comment